Does Sales Tech Stack Consolidation Pay? Here’s How to Calculate the Value

Updated:

Published:

If you had to guess, what percent of your sellers are actively using the sales technology you’ve purchased?

If you said less than half, you’re not alone.

As a value engineer, I am constantly talking with sales teams about the ROI of sales tech. Most of the teams I talk with need technology to help create, close, and keep business. They also want to increase the team’s productivity by making life easier.

Here’s the snag: To reach any of these goals, your team must use the technology you choose – something that’s less and less likely to happen with each application you add.

And so many of my conversations involve the idea of sales tech stack consolidation. There are over 1,000 sales technologies today; shiny bells and whistles abound. The latest features can often seem too tempting to pass up, and in many cases they are.

I’ve started encouraging revenue teams to evaluate technology differently. Think: Is it easy to use? Does it solve multiple challenges? Or is it just a point solution?

This article will explain why that is and how you get the greatest value from your sales tech stack.

How to Calculate the Cost of Your Current Sales Tech

The cost of technology goes beyond what you are paying the vendor. An audit will help you identify potential overlaps and inefficiencies. I suggest creating a simple spreadsheet that outlines:

- Sales technologies: Vendor, price, contact information, average onboarding time, etc.

- Key features: List all the features of each technology you use; highlight the ones your team tells you they’re not actually using (talk to them, and ask them to be honest!).

- Usage: Pull the stats to identify user adoption – who’s using what? Remember: adoption cannot be approximated as the mere percent of users logging into the tool. I suggest measuring adoption through the lens of activity. How many actions is an average user committing through the tool each day? That gets you closer to actual utilization.

- Support time: Get estimates from the RevOps team on how much time they spend troubleshooting and supporting integrations, and each tool.

- Core workflows: Map them to the technologies that enable them.

This spreadsheet is critical, but for each technology you’ve listed, there are multiple potential points of failure and soft costs across every team in your organization. That’s right, it isn’t just a revenue issue. Your legal and finance teams are likely reviewing and negotiating vendor contracts. IT is ensuring security compliance and compatibility for each software application.

Time, Money, and Opportunity Costs At-a-Glance

Points of Failure

- Sales Reps: Multiple technologies to learn and use

- Sales Ops/Revenue Ops (or IT): Multiple technologies to integrate, learn, support, and troubleshoot

- Sales Management, Finance, and Legal Teams: Multiple contracts to negotiate and manage

Time, Money & Opportunity Costs

- Sales Reps: Longer onboarding; lower user adoption; frustration switching between screens; potential missed sales

- Sales Ops/Revenue Ops (or IT): More challenging to identify where the problem is if something breaks; time spent troubleshooting takes away from more strategic work

- Sales Management, Finance, and Legal Teams: Inability to exercise economies of scale by increasing volume with a single vendor to drive price down; overlap in features likely with multiple sales technology

Evaluating the Soft Cost of Sales Technology

I said it before, but it bears repeating: You only get value from sales technology once your team knows how to use it and puts it to work. Soft costs come in time (which is money), frustration, and potential sales lost. If you can, assign a value to these soft costs and add to your spreadsheet.

- How many opportunities are you losing while reps onboard? Quantifying the costs of slower time for onboarding based on salary spend is easy. But calculating the opportunity cost of a non-optimized onboarding experience – pipeline and revenue not generated during ramp – is a bit trickier. I recommend creating a composite ‘fully ramped’ seller based on average pipeline and revenue generation per month in the onboarding rep’s org. Add missed monthly pipeline and closed/won revenue to your cost analysis.

- For existing reps, what steps could be eliminated from the sales workflow if one technology could do the work of multiple – and how critical are they? I’ve found that reps say they love ‘xyz’ vendor because of this shiny bell or that whistle. But when I dig deeper, I inevitably find that they’re using that vendor almost exclusively for standard features available in a comprehensive platform.

- How many screens do your reps need to flip between as they work during the day? The number one frustration I hear in conversations with sellers is that tech meant to boost productivity is actually a major time waster. There’s real value in bringing a seller’s workspace to a single screen with sales tech stack consolidation. It’s important not to underestimate the boost in seller focus that comes with increased ease and clarity in executing day-to-day tasks, which in turn boosts productivity.

- If something breaks, how long will it take to identify the issue? When it comes down to investigating one integration versus 10+? No contest. The more technologies in the stack, the more chances for things to break. When they do break, the tougher it is to identify which application or integration is causing the issue. One of the unsung benefits of sales tech stack consolidation is that there’s only one integration failure point. No wild goose chases trying to find the root of the problem.

- What activities are not happening when teams are focused on technology issues? Spending time fixing technology can muddle the operations team’s ability to perform the work they actually want to perform, like analyzing the go-to-market motion and using insights to inform strategic decisions such as compensation model planning, territory alignment, and more. Supporting the tech stack is just part of sales/RevOps purview – and to them, it’s likely the least interesting.

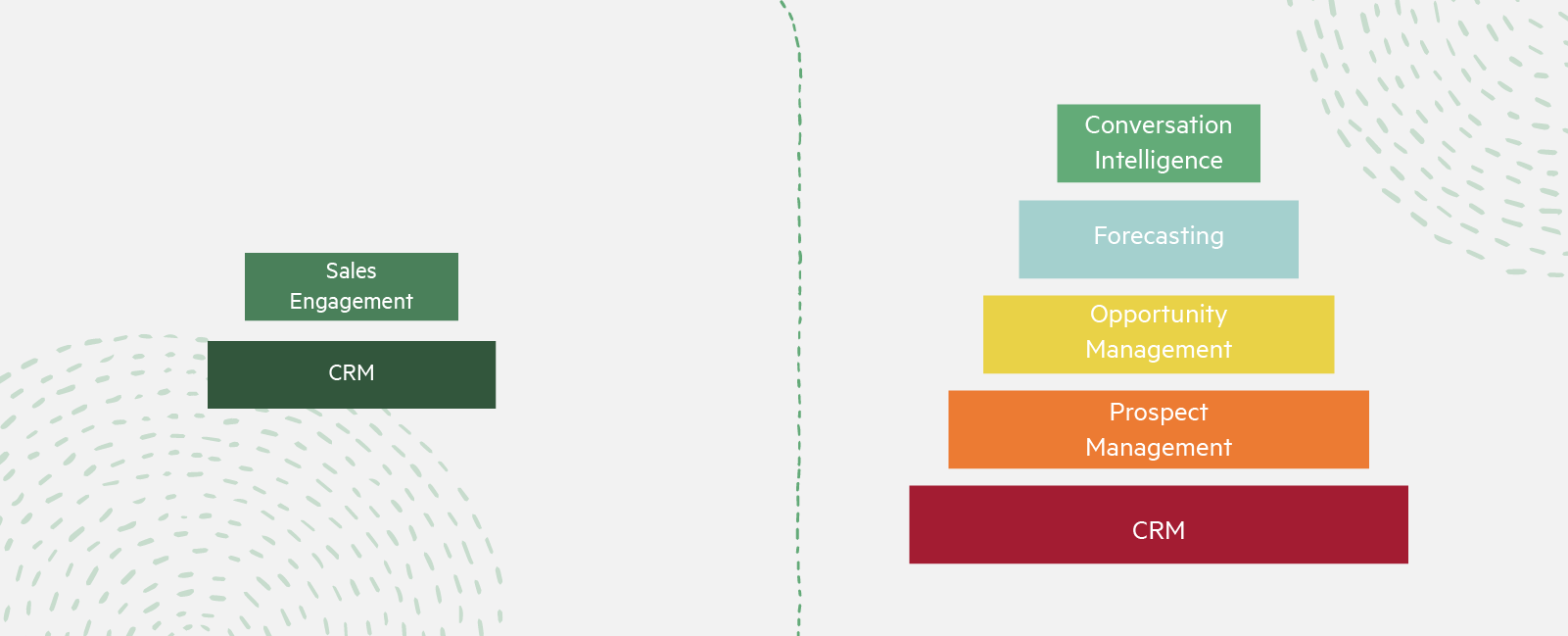

Which Sales Tech Stack Would You Prefer?

How to Calculate the Value of Sales Tech Stack Consolidation

You need technology that sellers will use. And you may be starting to realize that one product in your sales tech stack offers more capabilities than you are currently using. And it could even replace two or three other products. To find out, ask yourself these questions when your audit is complete:

- Did we give up negotiating power by purchasing multiple point solutions from different vendors?

- How much feature overlap is there between solutions?

- Are my reps using the tools to their fullest potential? For example, we got [insert solution] because it impressed us with its market-leading widget. But are reps even using that widget regularly? Or have they fallen back on the core functionality?

- How many RevOps and Enablement professionals support the tech stack? Could their time be better spent elsewhere?

I’ll leave you with a simple sales tech stack consolidation equation:

Consolidation Value = economies of scale + (marginal rep quota attainment * total reps) + (marginal RevOps seat efficiency * total RevOps seats)

And if you’re thinking about consolidating with the comprehensive Salesloft Revenue Workspace, I’m here to help!